Retail Express

Retailer Resiliency Score shows risks and opportunities

Retailer Resiliency Score shows risks and opportunities

2020-08-18

—

Online, liquor channels most resilient; mass, gas & c-store and dollar least resilient

Numerator has launched a Retailer Resilience Score for “Life on Pause” consumers.

Life on Pause consumers are one of six consumer segments identified in a Numerator segmentation study of 70,000 verified shoppers. The Life on Pause segment is of particular interest for retailers as this group is financially stable (meaning they have money and are willing to spend it) but has higher than normal concern about health. This means they are more likely to switch shopping behaviors and are a valuable segment for retailers to target. They are also the largest segment at 19% of total households – so a key factor in spending.

The analysis focuses on the index of Life on Pause consumers for specific retailer channels and specific retailers versus the average on two metrics: the % of Household penetration and the % of Spend. The difference between these two numbers results in the Retailer Resilience Score. (e.g., Life on Pause indexes at 103 as a percent of U.S. households for Target and at 114 as a percent of spend; this means these consumers are spending disproportionately at Target, giving Target a Retailer Resilience Score of 11).

High level findings (details below) from an analysis of both retailers and retail channels include:

- The five channels best poised to benefit from the spend-ready Life on Pause segment include the online, liquor, office, craft, and baby & toy channels.

- The five retail channels at most risk as Life on Pause consumers make choices to protect their health by limited trips and staying at home include mass, gas & convenience, dollar, department and home improvement stores.

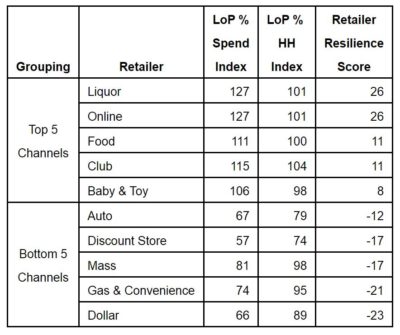

Life on Pause key findings for the top 5 and bottom 5 retail channels (in an analysis of 25) include:

Retail channels with top 5 / bottom 5 resilience scores

© Numerator

- While already popular with this segment, it is not surprising that Online is also strong at 26. Life on Pause indexes at 101 on HH penetration, but Spend significantly over indexes at a 27% increase over average.

- Likewise, the Liquor channel has a strong Resilience Score of 26 as this group is slow to engage in restaurants and bars and is enjoying cocktails at home.

- Food and club stores round out the top ten at Resilience Scores of 11 each. The Life on Pause segment is also one that has transitioned more seamlessly to bulk buying, enabling them to do fewer, larger trips to club stores in keeping with their concern about managing health.

- Mass, gas & convenience and dollar store channels are all hemorrhaging the valuable Life on Pause segments with scores of -17, -21, and -23 respectively.

Life on Pause key findings from a similar analysis done of specific retailers (versus total retail channel) include the following:

Retailers with top 5 / bottom 5 resilience scores

© Numerator

- Walmart and Dollar General have the most risk with Retailer Resilience Scores of -18 and -21 respectively.

- Home Depot is the most vulnerable given the higher presence of Life on Pause as part of their household base (103 index) but with decreased likelihood of spend (94 index).

- Dollar General and Dollar Tree have significant risk (at 62 and 70 indices on % of Spend).

- Whole Foods and Trader Joe’s lead the pack with high Retailer Resilience Scores with the Life on Pause segment.

“While overall spend on household goods surged with COVID, consumer buying is shifting with changes in financial and job security, ongoing health concerns, and changing attitudes about restaurants and re-entry change,” said Eric Belcher, CEO, Numerator. “Resilience with high value shopper segments like Life on Pause offers a leading indicator of retailer strength as consumer circumstances rapidly change.”

Source: Numerator